Offer In Compromise Letter Template Taxpayers experiencing tax debt troubles rarely compare the IRS deal in concession with the Phase 13 bankruptcy. Regularly, the Phase 13 will supply a more particular treatment for the taxpayer to settle tax financial debt. This short article checks out the family member advantages of both the offer in concession as well as Phase 13.

An deal in concession might be the most marketed tax solution. You can not listen to radio or enjoy television without being bombarded by ads to settle your tax debt. Frequently the advertisements proclaim that the internal revenue service has introduced that kindness in the collection of the tax obligation debt exists for a minimal time. The sad reality is that the leniency news by the IRS was commonly for other issue area, such as tax shelters. The IRS declines approximately 85 percent of all offers in concession filed as a result of question as to collectibility. Offers in concession are usually filed since the taxpayer believes the tax obligation financial obligation can not be paid, Doubt as to Collectibility is one of the most common kind of offer in compromise. Various other types of deals in concession are outside the scope of this article.

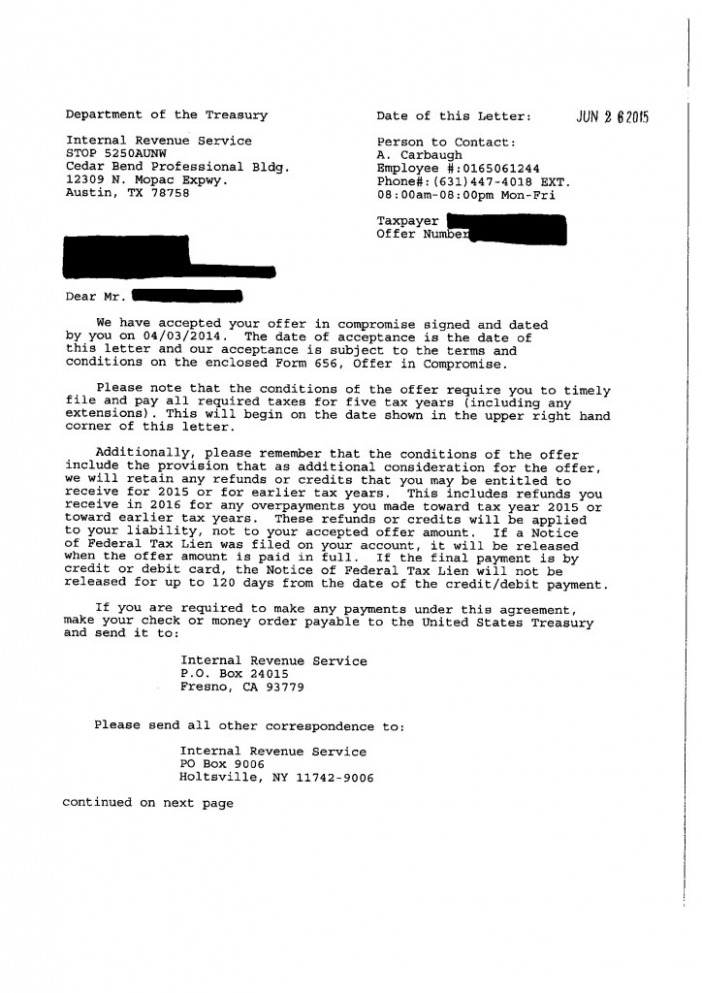

The advantage of the deal in compromise is that the tax responsibilities, including the relevant charges as well as rate of interest, are lowered to the quantity the internal revenue service as well as the taxpayer agree can be paid. Both events should agree to the terms of the deal in concession. The offer in concession is a agreement between the IRS and the taxpayer. The terms of the agreement can be implemented against the taxpayer in addition to the internal revenue service.

Approval of the deal in concession happens when the IRS thinks that the deal goes to least as much as could be gathered by the internal revenue service over the ten years life of the statute of restrictions. The IRS will certainly decline an deal that is for a minimal amount than it might or else accumulate.

The internal revenue service makes use of a uniform collection of monetary standards that are not adaptable in both the analysis of the amount paid monthly in an installation contract and in an offer in concession. These requirements limit the expenses for living that the taxpayer can claim are essential for living. The requirements include food, housing as well as energies, transport, and expense wellness expenditure. The standards might trigger radical troubles for a taxpayer with a reasonably higher standard of life. Overhead are not impacted by the standards.

The analysis of the minimum deal in concession that will certainly make the deal processable is the equity in the taxpayer’s properties plus the quantity that could be paid in an installation agreement over a specific amount of time. The period of the future regular monthly settlements considered by the IRS relies on exactly how the deal will be paid by the taxpayer. The internal revenue service wants 48 months of regular monthly settlement if the taxpayer supplies a round figure. The IRS desires 60 months of monthly payment if the offer is to be paid in a short term agreement of two years or much less. Nevertheless, the IRS will consider valid concerns such as retired life and health of the taxpayer in reducing the duration of the multiplier.